What is Stock Valuation?

Stock valuation is the method of calculating the theoretical values of companies and their stocks using their fundamentals and the current market dynamics. It is a crucial tool that helps us in making informed decisions about trading. This technique helps us estimate the current worth of an asset or a company.

Two main ways of evaluating value stocks which are as follows:-

- Absolute valuation

It is a method to calculate the present worth by forecasting the future income streams. Investors can determine if the current stock is under or overvalued by comparing it to the current price.

- Relative valuation

It is a method that compares a stock value to that of its competitors within the same industry to assess its worth. It is a handy and effective tool in valuing an asset.

Methods Used under Absolute Valuation:

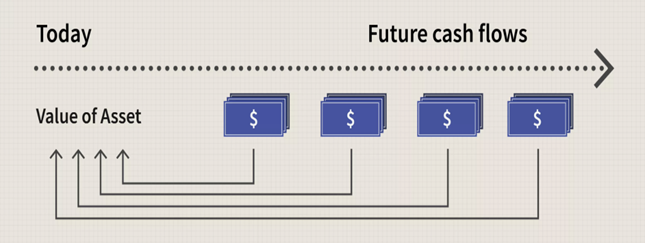

- Discounted Cash Flow Model

The discounted Cash Flow model is one of the best ways to determine a company’s intrinsic value or stock. Under this model’s approach, the stock’s intrinsic value is calculated by discounting the predicted cash flows to its present value. Using cash flow as a factor to estimate a company’s value is a better way to go than earnings, as earnings can be adjusted where cash flows are the cash left over for reinvestment or returning value to investors.

This model attempts to figure out the value of an investment today, based on how much money it will generate in the future. For example, the value of $100 in the future will be less than today because inflation causes money to lose value in the future. The only disadvantage of this model is that the factors used in projecting the cash flows, like growth rate, required return of equity, etc., are assumptions that might not be accurate. A lot of research goes into finalizing these assumptions, and if the research is correct and comprehensive, then so will be the results.

- Dividend Discount Model

The Dividend Discount Model is the most fundamental technique of absolute stock valuation; it calculates the asset’s actual value or the company by assessing its dividend pay-out to the shareholders. According to this model, the dividend is the representation of the actual cash flow of the company.

Download our ebooks

Get directly to your inbox

A company offers goods or services to earn profits. The cash flow earned from these business activities decides its profits, which gets reflected in the company’s stock price. These companies also make dividend payments to the stockholders, which usually comes from business profits. This model is based on the theory that the company’s value is the present worth of the sum of all its dividend payments of the future.

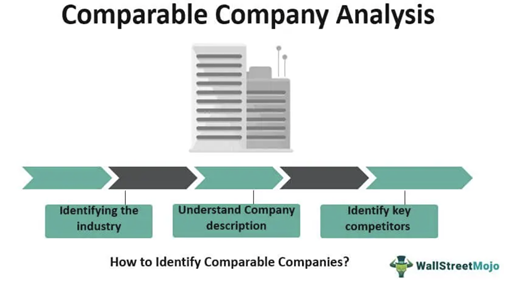

- Comparable Companies Analysis

This analysis is an example of relative stock valuation. Rather than determining the intrinsic value of a stock using the company’s fundamentals, a similar model aims to derive a stock’s theoretical price using the price of multiple similar companies. It functions under the assumption that similar companies should trade at similar multiples, all other things being equal.

This analysis starts with establishing a group or list of similar companies of similar size in the same industry. One can then compare a particular company to its competitors on a relative basis. Comparable analysis should provide a reasonable valuation range, while other valuation models such as the Discounted Cash Flow model depend on a varied number of assumptions.

Conclusion

If someone intends to invest in the stock market, they can use ratios and different methods to evaluate the value of a stock. However, these valuation models explained above are not the only tools to conduct trade, though the one the best ones. One should consider other parameters such as the trend lines and the company’s history you want to invest in. It is also prudent to conduct your research and analysis to obtain a clear view of the market.

To get the first free consultation to discuss stock valuation and determine its intrinsic aspects, click here.