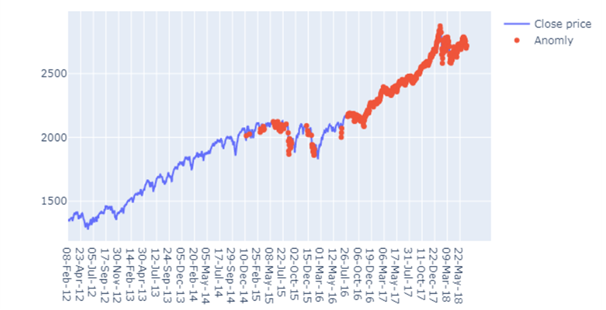

This blog will use the S&P 500 stock Dataset to Detect Anomalies training deep learning neural networks using Python, Keras, and Tensorflow.

The identification of rare items, events, or remarks which raise suspicion by significant differences from the bulk of the info in different areas such as statistics, signal processing, finance, economics, manufacturing, networking, and data processing, and anomaly detection (including outlier detection) is a different subject. To tackle this problem, we can use deep learning to solve it. Over the years, researchers have come up with various models for analysing and detecting such anomalies in sequential data.

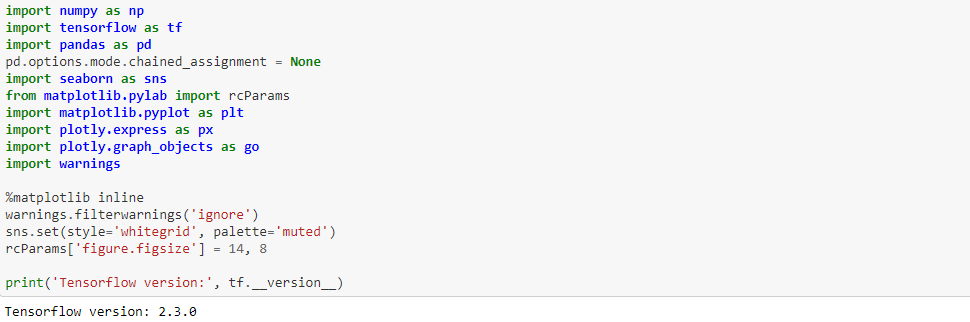

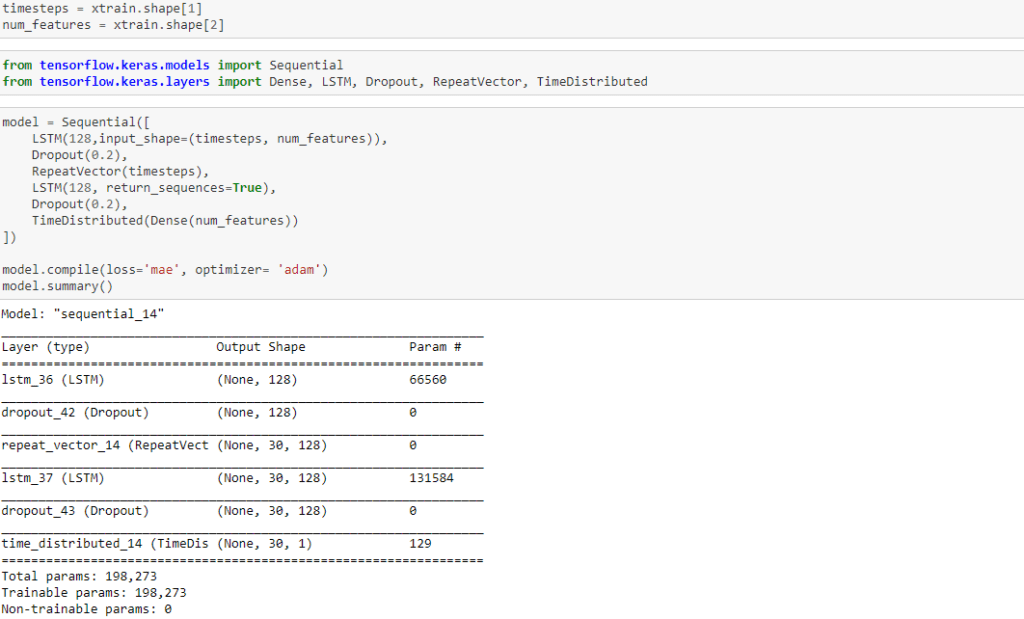

Now we can train our model on the sequential data to detect anomalies or outliers in our data which will help us for more statistical analysis. And use Keras Library, which is built over Tensorflow, for building our model:

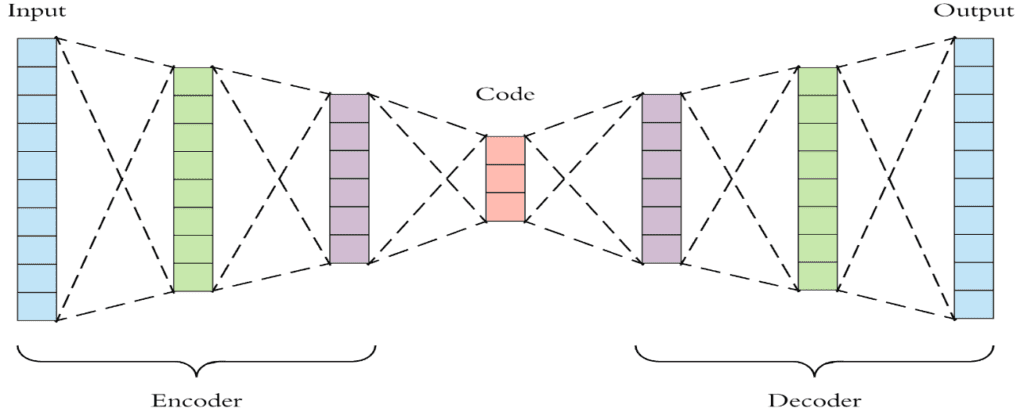

Now we can use a neural model called LSTM Auto-Encoder:

LSTM Auto-Encoder Code:

- Import Libraries:

- Load and Inspect the S&P 500 Index Data:

- Data Pre-processing:

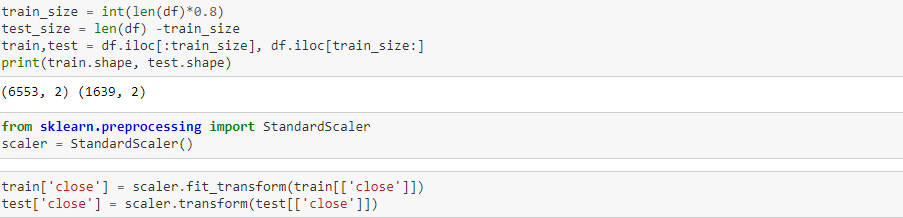

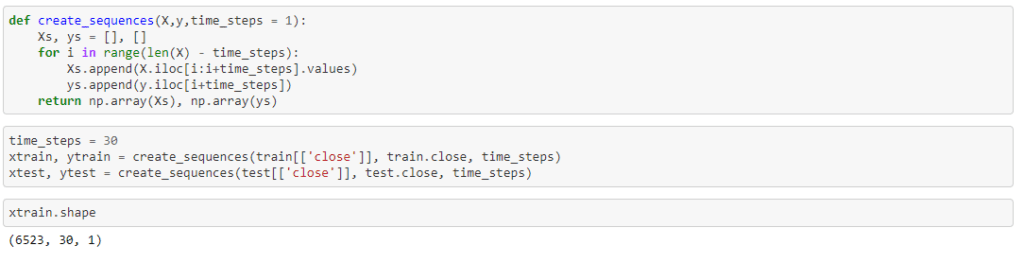

- Create Training and Test Splits:

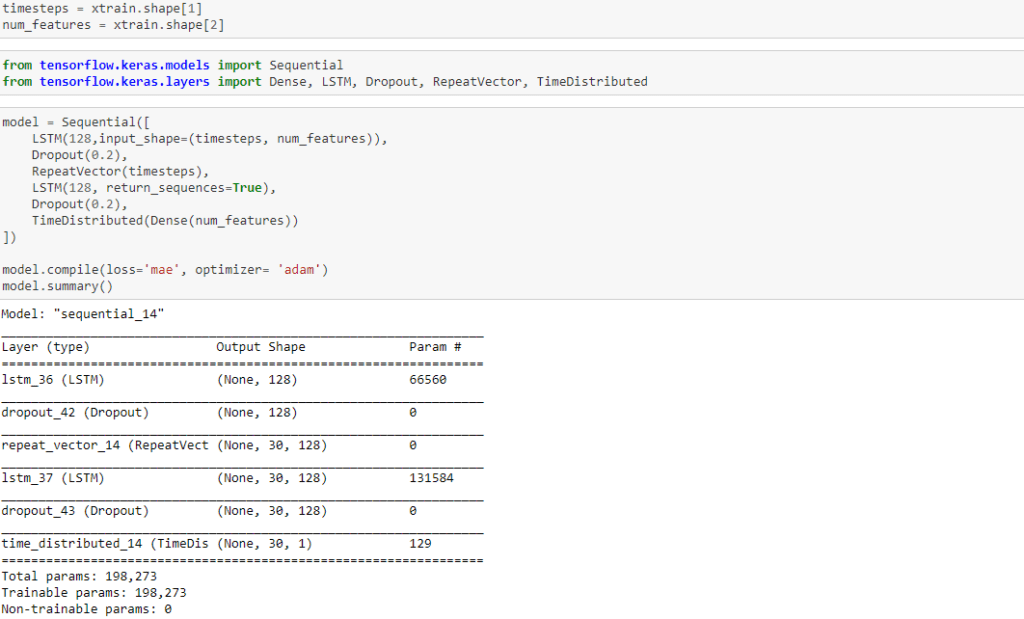

- Build an LSTM Auto-Encoder:

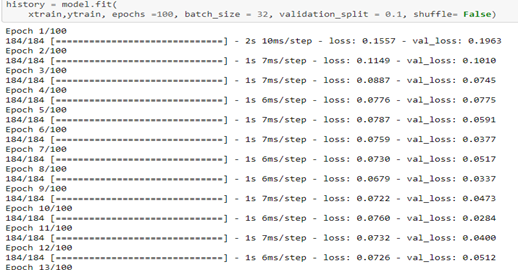

- Train the Auto-Encoder

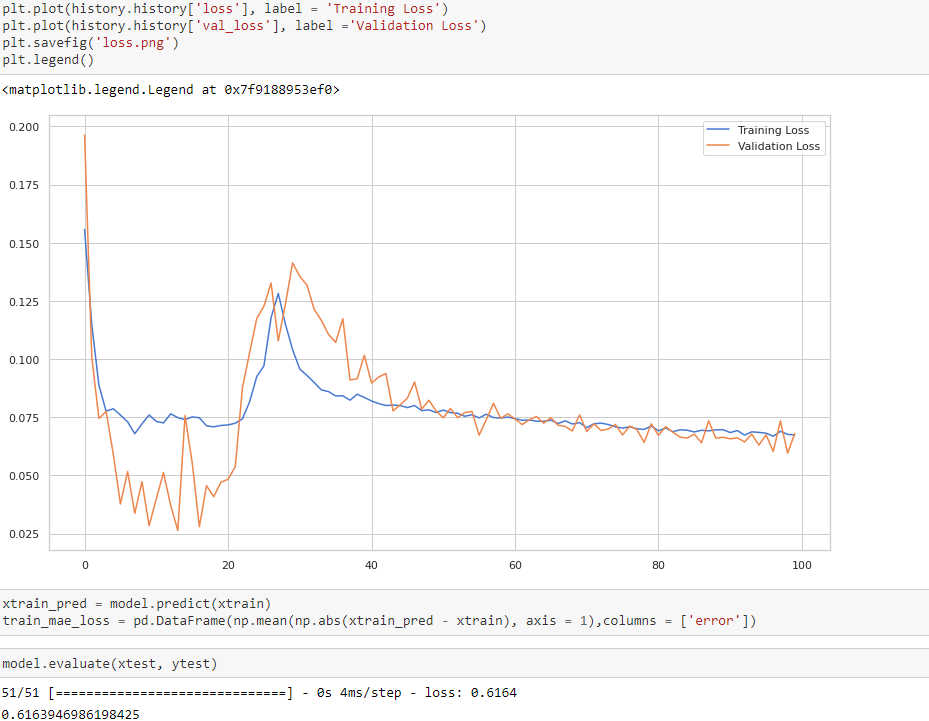

- Plot Metrics and Evaluate the Model:

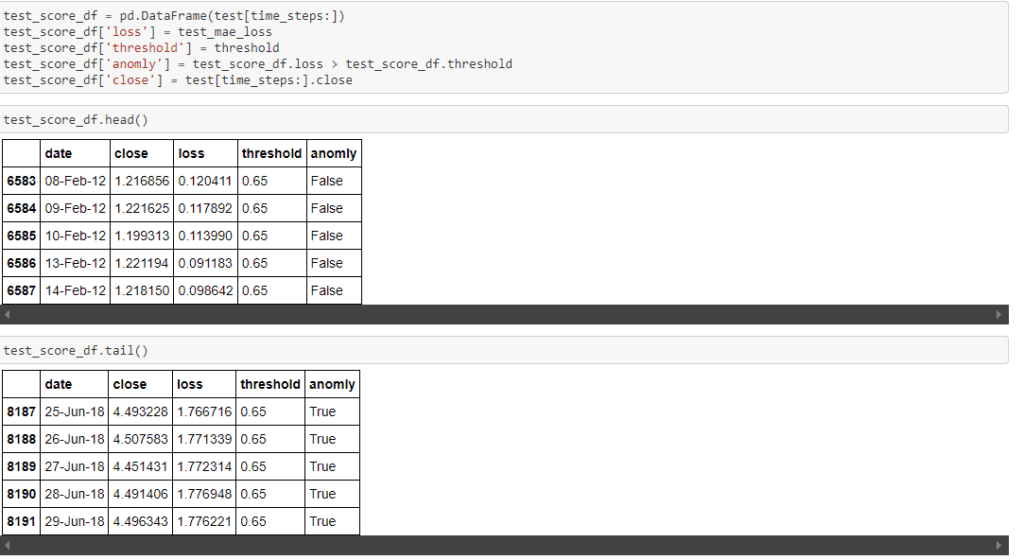

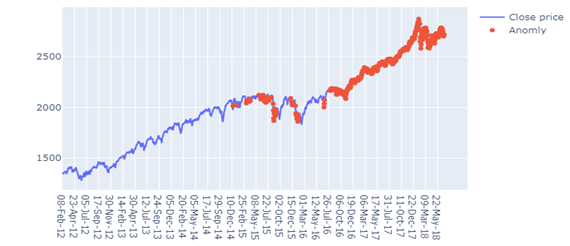

8. Detect Anomalies in the S&P 500 Index Data:

Therefore, we see that we can use LSTM Encoder-Decoder for Detecting Anomalies in Any Stock price.

Conclusion

Stock market prices are unpredictable to detect, but the numbers get used to finding commonality through statistics. Anomaly detection is the fundamental way of using statistics with the help of technical languages such as python, Keras, and Tensorflow.

To get the first free consultation for discussing more on how Anomaly detection helps in stock prices, click here.